Party Type: Operating Unit Owning Tax Content

Party Name: Vision Operations (Name of the OU you wish to setup for tax)

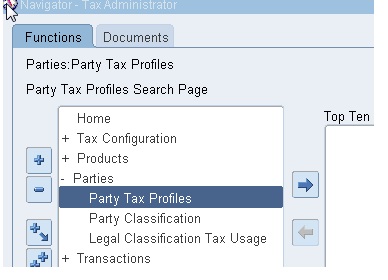

Navigation : Tax Manager/Administrator > Tax Configuration > Tax Regimes

We are going to create a United Kingdom regime.

Tax Regime Code XXX UK REGIME

Name XXX UK REGIME

Regime Level Country

Country Name United Kingdom

Effective From 10-Jan-2000

Parent Regime Code NULL

Used to Group Regimes Unchecked

Click on Show Controls and Defaults.

|

Field

|

Value

|

|

Controls:

|

|

|

Allow Tax Recovery

|

Unchecked

|

|

Allow Override and Entry of Inclusive Tax Lines

|

Checked

|

|

Allow Tax Exemptions

|

Checked

|

|

Allow Tax Exceptions

|

Checked

|

|

Defaults:

|

|

|

Tax Currency

|

GBP

|

|

Minimum Accountable Unit

|

0.01

|

|

Rounding Rule

|

Nearest

|

|

Tax Precision

|

2

|

|

Allow Multiple Jurisdictions

|

Unchecked

|

|

Field

|

Value

|

|

Party Name

|

Operating Unit

|

|

Party Type

|

Operating Unit Owning Tax Content *

|

|

Configuration for Taxes and Rules

|

Common Configuration

|

|

Configuration for Product Exceptions

|

Common Configuration

|

|

Effective From

|

10-Jan-2000

|

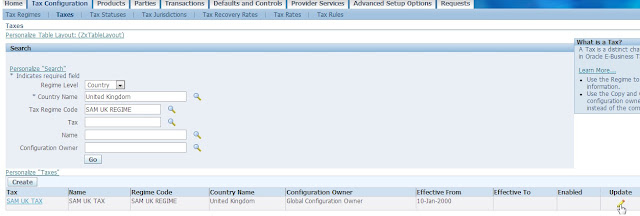

Navigation: Tax Manager/Administrator > Tax Configuration > Taxes

|

Field

|

Value

|

|

Tax Regime Code

|

XXX UK REGIME (From LOV – Regime defined in Step 1)

|

|

Configuration Owner

|

Global Configuration Owner

|

|

Tax Source

|

Create a New Tax

|

|

Tax

|

XXX UK TAX

|

|

Tax Name

|

XXX UK TAX

|

|

Tax Type

|

VAT

|

|

Geography Type

|

Country

|

|

Parent Geography Type

|

Country

|

|

Parent Geography Name

|

United Kingdom

|

|

Set as Offset Tax

|

Unchecked

|

|

Set Tax for Reporting Purposes

|

Unchecked

|

|

Field

|

Value

|

|

Controls:

|

|

|

Allow Tax Inclusion

|

Unchecked

|

|

Allow Override and Entry of Inclusive Tax Lines

|

Checked

|

|

Allow Tax Rounding Override

|

Checked

|

|

Allow Override for Calculated Tax Lines

|

Checked

|

|

Use Legal Registration Number

|

Unchecked

|

|

Allow Multiple Jurisdictions

|

|

|

Allow Mass Creation of Jurisdictions

|

Checked

|

|

Defaults:

|

Checked

|

|

Allow Tax Rate Rules

|

Checked

|

Tax Manager/Administrator > Tax Configuration > Tax Statuses

Click Create

|

Field

|

Value

|

|

Tax Regime

|

XXX UK REGIME (From LOV in Step 1)

|

|

Tax

|

XXX UK TAX (From LOV in Step 2)

|

|

Tax Status Code

|

XXX UK STATUS

|

|

Name

|

XXX UK STATUS

|

|

Effective From

|

10-Jan-2000 (Defaults)

|

|

Set as Default Tax Status

|

Checked

|

|

Default Status Effective From

|

10-Jan-2000 *

|

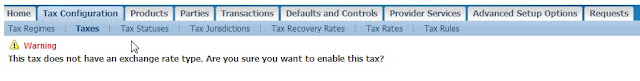

View confirmation message:

|

Field

|

Value

|

|

Tax Jurisdiction Code

|

XXX UK JURISDICTION

|

|

Tax Jurisdiction Name

|

XXX UK JURISDICTION

|

|

Tax Regime Code

|

XXX UK REGIME (From LOV Step 1)

|

|

Tax

|

XXX UK TAX (From LOV Step 2)

|

|

Geography Type

|

COUNTRY

|

|

Effective From

|

10-JAN-2000

|

|

Geography Name

|

United Kingdom

|

|

Default Tax Jurisdiction Settings:

|

|

|

Set as default Tax Jurisdiction

|

Checked

|

|

Default Effective From

|

10-Jan-2000

|

Ensure confirmation message is received.

|

Field

|

Value

|

|

Tax Regime Code

|

XXX UK REGIME (From LOV Step 1)

|

|

Configuration Owner

|

Global Configuration Owner

|

|

Tax

|

XXX UK TAX (From LOV Step 2)

|

|

Tax Status Code

|

XXX UK STATUS (From LOV Step 3)

|

|

Tax Jurisdiction Code

|

XXX UK JURISDICTION (From LOV Step 4)

|

|

Tax Rate Code

|

XXX UK RATE

|

|

Rate Type

|

Percentage

|

|

Rate Periods:

|

|

|

Percentage Rate

|

20

|

|

Effective From

|

01-Jan-2000

|

|

Field

|

Value

|

|

Set as Default Rate

|

Checked

|

|

Default Effective Date

|

01-Jan-2000

|

Tax Manager/Administrator > Tax Configuration > Taxes

Query XXX UK Tax -> Click Go -> Click Tax Accounts

Enter the Operating Unit and populate Tax Expense and Tax Recoverable/Liability accounts.

Click Apply. & Click Apply again Click Apply a third time

Click Apply a third time

Tax Manager/Administrator > Tax Configuration > Tax Rules

Enter the following:

|

Field

|

Value

|

|

Configuration Owner

|

Global Configuration Owner

|

|

Tax Regime Code

|

XXX UK REGIME

|

|

Tax

|

XXX UK TAX

|

|

Field

|

Value

|

|

Determine Place of Supply

|

Ship to, use bill to if ship to is not found

|

|

Determine Tax Applicability

|

Applicable

|

|

Determine Tax Registration

|

STANDARD_TB

|

|

Calculate Tax Amounts

|

STANDARD_TC

|

Click on Update Pencil Icon

Payables > Invoices : Entry > Invoices

Recent Comments