Definition Access Sets are an optional security feature that allow you to secure shared General Ledger definitions such as Mass Allocations, Recurring Journal Formulas, and Financial Statement Generator (FSG) components. Definition Access Sets allow you to:

• Assign a user or group of users access to specific definitions.

• Specify what actions can be performed on secured definitions for a user or group of users.

For example, you can secure FSG reports to allow some users to modify the report definition, other users to only view the report definition, while other users can modify, view, and submit the report.

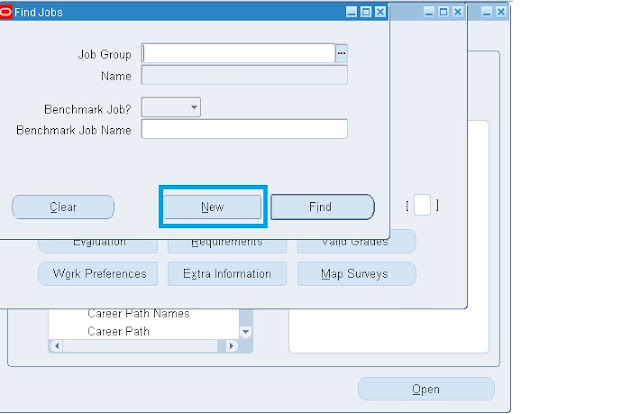

1. Create a Definition Access Set.

2. Assign it to one or more responsibilities.

3. Create a definition.

4. Secure the definition in its respective window and assign it to a Definition Access

Set with the proper privileges.

You can control who has access to definitions by assigning them to Definition Access Sets with one or more of the following privileges:

Enables a user to use a definition in a process or report, such as FSG Report components, Recurring Journal, and Mass Allocation definitions. It also enables a user to use the definition to create another definition, such as using a Recurring Journal to create an AutoAllocation Set or using a FSG Report component to create a FSG report.

If a user only has Use access to a definition, that user cannot view or modify the definition. For example, if a user only has Use access to a Mass Allocation definition, that user can generate journals using the Mass Allocation in the Generate Mass Allocation Journals window, but she cannot view or modify the definition in the Define Mass Allocation window.

• View:

Enables a user to view a definition. If a user only has View access to a definition, that user cannot use or modify the definition. If AutoCopy is available as a function for that particular definition, the

user will be able to use AutoCopy to create a copy of the definition. This allows the user to create a definition based on an existing definition without changing the original.

• Modify: Enables a user to View and Modify a definition. Modify access automatically includes View access.

If a user only has Modify access to a definition, that user cannot use the definition.

1.Defining Definition Access Sets

Navigation: General Ledger –> Setup –> Financial –> Definition Access Sets –> Define

1. Enter a Name and Description. You cannot modify or delete the Name once it is saved.

Tip: You can initially create a Definition Access Set that has no associated definitions. While subsequently creating a definition, you can secure it by choosing the Definition Access Set from the List of Values in the Definition’s Assign window.

Tip: For ease of maintenance, consider a naming convention foryour Definition Access Sets that group similar definitions together.

For example, you can create a Definition Access Set that groups similar definitions together, such as all of your FSG components. Alternatively, you can create definition access sets that group definitions by privileges, such as Use, View, and Modify privileges. Because you can have an unlimited number of Definition Access Sets assigned to a responsibility, a good naming convention prevents confusion as you secure more definitions in the future.

2. (Optional) From the Definitions region, you can add definitions to the Definition Access Set. To do so, choose a Definition Type and Name from the List of Values. Only definitions that have been secured with the Enable Security checkbox checked in the definition window will be available.

3.Assign one or more privileges to the definition:

Use: The definition can be used.

View: The definition can be viewed.

Modify: The definition can be viewed and modified. View defaults automatically.

4. Repeat steps 3 and 4 to add more definitions to the Definition Access Set.

5. Save your work.

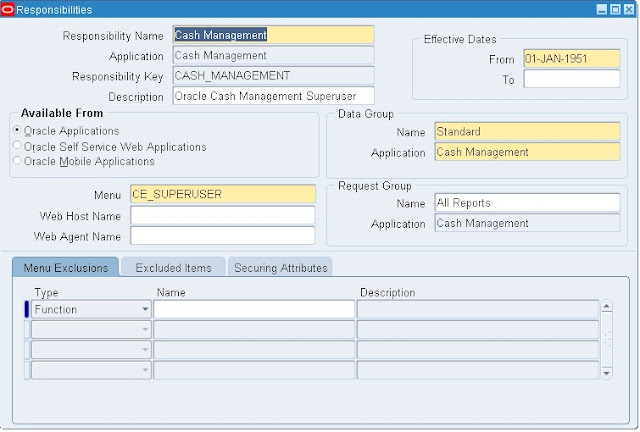

2.Assign Definition Access Set to a Responsibility.

Navigation: General Ledger –> Setup –> Financial –> Definition Access Sets –> Assign.

1.. Select a General Ledger Responsibility that will be assigned to the Definition Access Set .

2. In the Assignments region, choose one or more Definition Access Sets to assign.

Note: The definition access sets you assign will appear in the list of values in the Assign window when securing each definition in their respective definition window.

3. (Optional) Enable the AutoAssign checkbox to automatically have definitions created by responsibility assigned to the Definition Access Set. If you enable AutoAssign, you must choose default privileges for those responsibilities. Specify one or more AutoAssign Privileges for the Definition Access Set: your choices are

Use, View, and Modify.

Note: You will be able to override the privileges when securing the individual definitions if you have the Assign Access button available in the respective definition window. If the Assign Access function has been excluded for this definition from your responsibility, the button will not appear in the respective definition window. The following table lists General Ledger definitions that can be secured and explains what Use, View, and Modify access mean for each definition.

Securing Calendars

You can secure your calendar definition using definition access sets. Definition access sets are an optional security feature that allows you to control use, view, and modify access to your General Ledger definitions.

For accounting calendars, only View and Modify access are applicable.

View Access: Allows specific users to view the calendar definition from the Accounting Calendar window. If you have view access, you will be unable to make changes to the calendar definition.

Modify Access: Allows specific users to view and make changes to the calendar from

the Accounting Calendar window.

Prerequisite

• Carefully consider the type of calendar you need for your organization, since it canbe difficult to change your calendar (e.g., from a fiscal year to a calendar year) once you’ve used it to enter accounting data. Changing your calendar may require assistance from an Oracle consultant.

• Define your accounting period types

To define a new calendar:

1. Navigate to the Accounting Calendar window.

2. Enter a Name and Description for the calendar.

3. Add the periods that make up the calendar year.

4. (Optional) Select the Enable Security check box to apply definition access set

security to the Calendar definition. If you do not enable security, all users who have access to this calendar definition will be able to view and modify the calendar definition. If the Assign Access function is available for your responsibility, the Assign Access button is enabled once you check the Enable Security check box. Choose the Assign Access button to assign the calendar definition to one or more Definition Access Sets with the desired privileges. If the Assign Access function has been excluded from your responsibility, you will

not be able to view the Assign Access button in the Accounting Calendar window. You can still secure the calendar by checking the Enable Security check box, but only Definition Access Sets that are AutoAssigned will be automatically assigned to this calendar. See your System Administrator for more information on Function Security.

5. Save your work.

Note: When you exit the Accounting Calendar window, full calendar validation is launched. You can choose to validate all calendars or the current calendar. Navigate to Help > View > My Requests to view or print the Calendar Validation Report. This report helps you identify any errors in your calendar that might interfere with the proper operation of General Ledger.

Save.

Recent Comments