Procure to Pay Process flow:

————————————–

Let’s see the steps involved in performing using Oracle Applications

1. Oracle Purchasing: You enter Suppliers of different materials and products you want to purchase to manufacture a finished good that your organization plans to sell.

2. Oracle Purchasing: You prepare a Request for Quotation (RFQ) and send it to different suppliers to get the best and/or economical price for the product.

3. Oracle Purchasing:

3. Oracle Purchasing:Suppliers sends their quotations and you upload those quotations in Oracle Purchasing to get the best three quotes and further to get the one best quote.

4. Oracle Purchasing: You prepare a Purchase Order(PO) against the best RFQ to buy the goods from the supplier who quoted the suitable price and sends the PO to that supplier

5. Oracle Purchasing: The supplier receives the confirmation of purchase from PO and ships the ordered goods. You receive the goods enter a Goods Received Note (GRN) in Oracle Purchasing.

6. Oracle Inventory:It’s up to you whether you want to receive the goods at your head office or you Inventory directly. In either case you move the received goods to your different Raw Material Inventory from Oracle Purchasing to Oracle Inventory and the Item Count increases.

7. Oracle General Ledger: Once you move the goods to Oracle Inventory, it sends the Material Accounting to Oracle General Ledger.

8. Oracle Payables: After that the supplier sends you the invoice for the purchased goods and you Enter or Match the invoice against the PO from Oracle Purchasing in Oracle Payables.

9. Oracle General Ledger: When you enter the invoice it means that you have created a Liability against that supplier.

10. Oracle Payables: You pay the invoice and settle the Liability

11. Oracle General Ledger: The liability is settled, your expense is recorded.

12. Oracle Process Manufacturing(OPM) / Oracle Discrete Manufacturing(ODM):

You start the manufacturing of your final product. Both OPM or ODM requests the different raw materials from you inventory organizations and manufactures a finished good.

13. Oracle Inventory: As the raw materials are issued to OPM and ODM the inventory sends the issuing material accounting to General Ledger and decreases the Item Count from the Raw Material Store. As the finished good is prepared, Oracle Inventory receives the finished good in Finished Good Store and increase the Item Count.

Payable Integration:

——————————

Payables Processes:

————————–

Overview of Suppliers:

——————————-

When you enter a supplier that does business from multiple locations, you enter header information only once, and you enter supplier sites for each location. Most supplier information defaults to supplier sites. However, you can override the values that default if necessary. After you define suppliers, you can use them when you import/enter invoices and create purchasing documents Define how supplier sites can be used with the following options:

• Pay – You can import/enter invoices for and make payments to the site.

• Primary Pay – Default pay site for invoice entry and import.

• Purchasing – You can create purchase orders for the site.

• RFQ Only – You can create request for quotations in Purchasing for the site. You cannot

create purchase orders for an RFQ Only site.

• Procurement Card – You can purchase goods or services using a procurement card.

• Primary Pay – If a supplier has multiple pay sites, one can be designated as the primary.The primary pay site defaults in the Invoices window, helping to speed the invoice entry process. Also, Payables Open Interface Import uses this site when it imports an external invoice with no specified site.

Designate a site as an RFQ Only site during the beginning of negotiations with a supplier. If you decide to use the supplier, designate the supplier site as a Purchasing site by deselecting the RFQ Only option and selecting the Purchasing Site option. For each supplier site, you can enter contact information (name, address, telephone) specific to that site. Contact information is for your reference only.

Flow of Default Values(P2P):

—————————————-

• Defaults set at higher levels flow down to lower levels where you can override them.

• Defaults reduce data entry by providing default values based on corporate policy.

Optional defaults (especially the higher level ones) should be left blank if you frequently override them.

• Purchase order matched invoices will receive defaults from the purchase order you specify when you match. Note: Changes to default values affect only new records, not existing records. For example, if

payment terms in the Payables Options window are reset to Net 15 from Net 30, new suppliers will have a default of Net 15. Existing suppliers will have terms of Net 30.

Invoice Entry:

——————–

You can enter invoices through:

•

Manual entry: Manually enter invoices in the Invoice Gateway and Invoices windows.

•

Import: The Payables Open Interface Import program imports invoices from the Payables Open Interfaces table. This table is loaded by many sources including invoices entered online by suppliers in iSupplier Portal, invoices sent by suppliers in EDI or XML formats, and Oracle applications that load invoices into the Open Interfaces Table such as Oracle Property Manager and Oracle Assets.

•

Automatically generated: Oracle Payables automatically generates the following invoice

types: withholding ax invoices to pay tax authorities, interest invoices, and payment on receipt invoices.

•

Recurring invoices: You can set up Oracle Payables to generate regularly scheduled invoices such as rent.

•

Matching: You can match most invoices to purchase orders or receipts. You can group manually entered and imported invoices in invoice batches.

Invoice import:

———————

Oracle Internet Expenses expense reports:

Expense reports your employees enter using a Web browser.

Payables expense reports:

Expense reports entered in the Payables Expense reports window by the Payables department.

Credit Card invoices:

Invoices for employee credit card expenses. The credit card company sends you these invoices as a flat file.

Oracle Projects expense reports:

Project–related expense reports entered in Oracle Projects.

EDI invoices:

Electronic invoices transferred from Oracle e–Commerce Gateway.

Invoices from external systems:

Invoices, such as invoices from legacy systems, loaded using SQL*Loader.

Oracle Property Manager invoices:

Lease invoices transferred from Oracle Property Manager.

Oracle Assets lease payments:

Lease payments transferred from Oracle Assets.

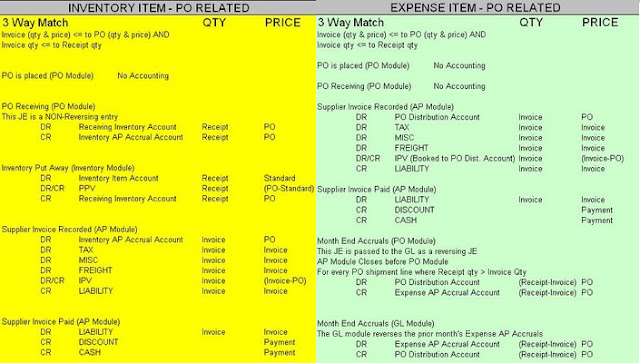

Oracle Procure to Pay Accounting:

——————————————-

As you know “procure to pay” Business Flow start Purchasing requisition till paying to supplier and most important, in all the case the purchase is made for basic element called Items.

There are three types of items:

1. Inventory Asset Item/Inventory item-PO Related

2. Inventory Expense Item/Inventory Expenses – PO Related

3. Expense item/Non-PO Invoice.

1. Inventory Asset Item/Inventory item-PO Related : 2. Inventory Expense Item/ Expense Item-PO Related:

————————————————————————————————————

3. Expenses items/ Non-PO Invoice:

————————————–

Recent Comments