Accrual Basis Accounting

Under the accrual basis accounting, revenues and expenses are recognized as follows:

AR:

- Revenue recognition: Revenue is recognized when both of the following conditions are met:

a. Revenue is earned.

b. Revenue is realized or realizable. - Revenue is earned when products are delivered or services are provided.

- Realized means cash is received.

- Realizable means it is reasonable to expect that cash will be received in the future.

AP:

- Expense recognition: Expense is recognized in the period in which related revenue is recognized (Matching Principle).

Cash Basis Accounting

Under the cash basis accounting, revenues and expenses are recognized as follows:

AR:

- Revenue recognition: Revenue is recognized when cash is received.

AP:

- Expense recognition: Expense is recognized when cash is paid.

Timing differences in recognizing revenues and expenses:

- Accrued Revenue: Revenue is recognized before cash is received.

- Accrued Expense: Expense is recognized before cash is paid.

- Deferred Revenue: Revenue is recognized after cash is received.

- Deferred Expense: Expense is recognized after cash is paid.

Options in 11i To Options in 12

Options in 11i To Options in 12

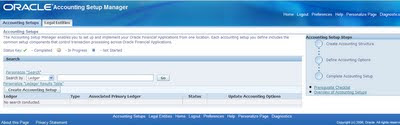

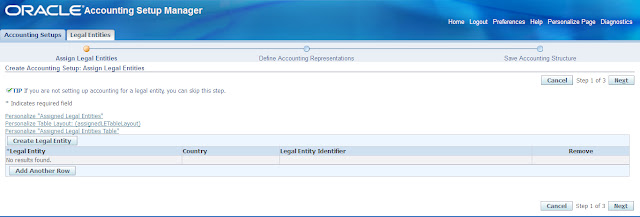

Till 11i the only way we represent this accounting method is by choosing accounting method in Payables Options in AP and System Options in AR. But in R12 you can see in that these options are gone from the system options of AP and AR. That is where subledger accounting comes in.

Part of the global release concept in R12, accounting methods have to be much more flexible and generation of accounting entries should be configurable.

As we know accounting is the end product of transctions and financial statements are end products of accounting. Also there is a need to seperate transaction from accounting. An accounting clerk who creates an invoice has nothing to do what accounting is behind that transaction. It is the duty of the management to decide accounting behind this transaction.

Subledger Accounting is taking us in that direction.

Purpose of Subledger Accounting

The end product of Subledger Accounting Setups is a Subledger Accounting Method that can be assigned to one or more ledgers in GL. All accounting in different subledger applications is subject to the rules defined in this accounting method.

In 11i, as mentioned earlier, the only way to choose accounting method we chose is AR and AP system options setup (Cash Vs Accrual). We used start in GL setting up the Set of books and then define the organization information like Legal Entity and Operating units and so on. And then define these accounting methods for each operating unit. As you can see operations and accounting are so closely meshed with each other. But in R12 it is not the same. In this release it is now configurable in Subledger Accounting setups taking this away from system options of individual products.

Demystifying subledger accounting setups

Out of the box, Oracle seeds accounting rules for all applications. If you are satisfied with the Oracle’s seeded rules, there is no need to change any setup and you can use those existing rules (Accounting Method for Accrual is Standard Accrual and for Cash is Standard Cash). This screenshot here shows you the difference between the Accrual Basis of accounting and Cash Basis of Accounting. As you can see here, per rules, there is no accounting created when invoice is created under cash basis (no revenue is recognized until cash is received) but accounting is created when cash is realized. Invoice is accounted as soon it is completed under Accrual Method. This is configurable here where as in 11i we did not have a choice!.

Out of the box, Oracle seeds accounting rules for all applications. If you are satisfied with the Oracle’s seeded rules, there is no need to change any setup and you can use those existing rules (Accounting Method for Accrual is Standard Accrual and for Cash is Standard Cash). This screenshot here shows you the difference between the Accrual Basis of accounting and Cash Basis of Accounting. As you can see here, per rules, there is no accounting created when invoice is created under cash basis (no revenue is recognized until cash is received) but accounting is created when cash is realized. Invoice is accounted as soon it is completed under Accrual Method. This is configurable here where as in 11i we did not have a choice!.

If you choose this accounting method, accounting works exactly the way it works in previous releases.

Subledger Accounting as a gatekeeper of Reconciliation

R11i Transfer to GL R12 Transfer to GL

Starting R12 all accounting entries are generated and passed through subledger accounting application instead of directly going to GL. Hence reconciliation is already done between source to Subledger Accounting and Subledger Accounting to GL, reducing huge amount of time spent on reconciliation. Since these entries have to flow through the subledger accounting application, there is a need to map the source application accounting entries to subledger accounting. That is key for the setups.

Starting R12 all accounting entries are generated and passed through subledger accounting application instead of directly going to GL. Hence reconciliation is already done between source to Subledger Accounting and Subledger Accounting to GL, reducing huge amount of time spent on reconciliation. Since these entries have to flow through the subledger accounting application, there is a need to map the source application accounting entries to subledger accounting. That is key for the setups.

Mapping a transaction to Subledger Accounting Setup

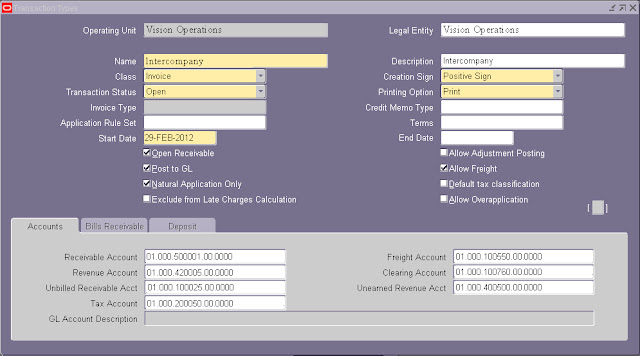

AR Invoice Accounting

AR Invoice Accounting

Let us take a simple example. Whenever you create an AR Invoice following accounting takes place.

Invoice Accounting in AR

Taking a step back and thinking through, this transaction is happening in AR for the Invoice Creation event….

Taking a step back and thinking through, this transaction is happening in AR for the Invoice Creation event….

Subledger Accounting Setup Model

Now we map the source (AR Invoices) to Subledger Accounting as shown here. So to conclude

Now we map the source (AR Invoices) to Subledger Accounting as shown here. So to conclude

Journal Line Types are nothing but accounting line types (Receivable or Revenue).

Event Classes identify a transaction type (Invoice Vs Credit Memo).

These two are assembled using Accounting Derivation Rules and Sources.

All these together make up Application Accounting Definition for Receivables.

Different Application Accounting Definitions together make up a Subledger Accounting Method.

This method can be attached to one or more Ledgers.

Recent Comments