Revaluing Foreign Currency BalancesAsset and Liability accounts that are entered in foreign currencies must be revalued every period in accordance with FAS52 (Financial Accounting Standards). The Revaluation program adjusts the value of the balance sheet accounts based on current period exchange rates. It then generates revaluation journals with adjustments to the defined unrealized gain/loss account. The Revaluation program generates adjustments in the Functional Currency. If you have a Reporting Set of Books you must run revaluation once for each Primary and Reporting Set of Books. The Revaluation generates a revaluation batch containing a separate journal for each foreign currency. The revaluation batch automatically has its reversal period set to the next accounting period. When you run revaluation for the next accounting period, you must reverse and post the last accounting periods revaluation batch first.

You get to the Revalue balances form by following navigation path

Currency->Revaluation

Translating Foreign Currency BalancesThe Translation process translates actual and budget account balances to another currency in accordance FAS52. The translation program uses three different exchange rates: period-average, period end, and historical. The translation program translates asset and liability accounts using the period end exchange rate, ownership/stockholder equity accounts using the historical exchange rate, and revenue and expenses accounts using period average exchange rate. The period average exchange rate is the average rate of all daily rates across the entire accounting period.

The profile option GL: Owners equity transaction rule effects how ownership stockholders equity account balances are translated. If the profile option is set to PTD, the net activity accounts of the accounting period are translated, then added to the corresponding prior period balances. If the profile set to YTD the balances, not the activities are translated and the translated amounts are the YTD Balances. There is no need to add the balances to previous balances.

Navigation Currency-> Translation

Multiple Reporting Currencies

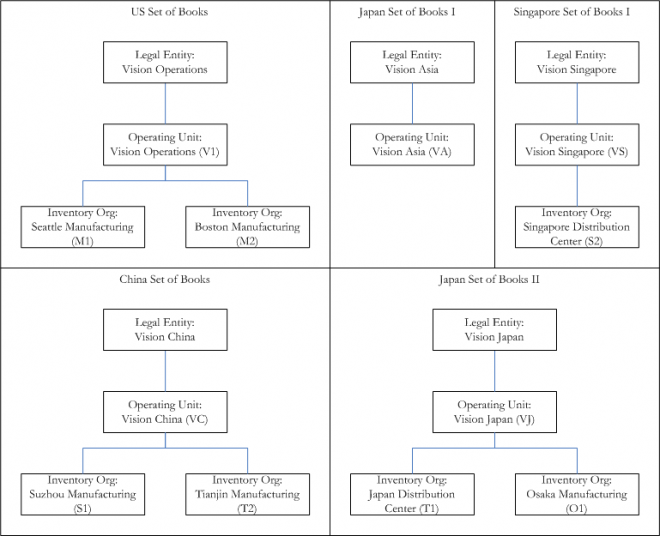

Multiple Reporting Currencies allows you to maintain accounting transactions in more than one functional currency. MRC is set up by creating one or more Reporting Set of Books.

MRC need if

Your company is located a member state of EMU and would like to report financial data, including transaction level data, in both your functional currency and the Euro.

You must regularly report financial data including transaction level data in more than one currency because your company is multinational.

MRC Works for following modules

Assets, CashManagment, Cost Management , General Ledger, Payables, Projects, Purchasing, Receivables.

MRC works differently depdning on whether you enter the transaction inn Oracle Subledger or Oracle GL. When you enter transaction in subledgers the accounting transactions are translated into the Reporting set of books as you enter the transaction. When you transfer to Oracle GL, you must transfer to both the primary set of books and the reporting set of books you should post the transferred subledgers accounting transactions to the primary set of books as well as to all reporting set of books.

When you enter transactions in GL, the journal entries entered in the Primary Set of Books are not translated immediately into any reporting Set of Books, when the Journal entries are posted

In the Primary Set of Books it will transferred to reporting Set of Books. In the reporting Set of Books you can post, revalue , translate and consolidate.

Recent Comments