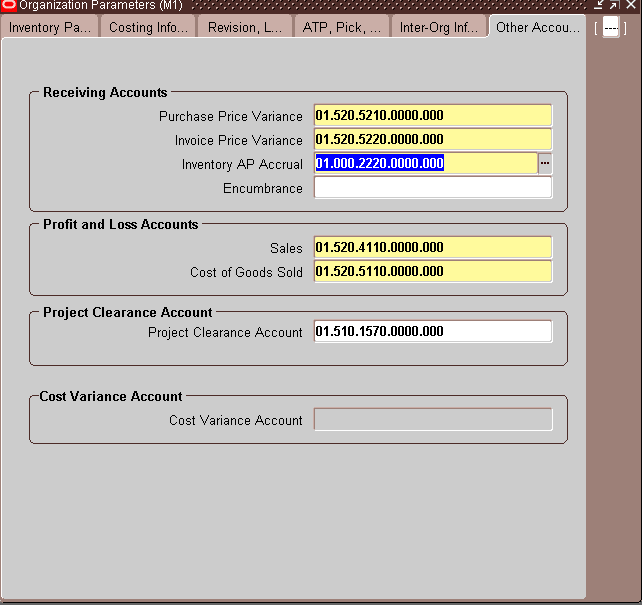

Other Accounts

Encumbrance: An expense account used to recognize the reservation of funds when a purchase order is approved.

Inventory A/P Accrual : The liability account that represents all inventory purchase order receipts not matched in Accounts Payable, such as the uninvoiced receipts account.

Purchase Price Variance : The variance account used to record differences between purchase order price and standard cost. This account is not used with the average cost method.

Invoice Price Variance : The variance account used to record differences between purchase order price and invoice price. This account is used by Accounts Payable to record invoice price variance.

Cost of Goods Sold: The profit and loss (income statement) account that tracks the default cost of goods sold account.

Sales: The profit and loss (income statement) account that tracks the default revenue account.

Project Clearance Account: When performing miscellaneous issues to capital projects, the project clearance account is used to post the distributions.

Average Cost Variance: Under average costing with negative quantity balances, this account represents the inventory valuation error caused by issuing your inventory before your receipts.

Note: For standard costing, only the Purchase Price Variance, Inventory A/P Accrual, Invoice Price Variance, Expense, Sales and Cost of Goods Sold accounts are required. The other accounts are used as defaults to speed your set up.

Note: For average costing, only the Material, Average Cost Variance, Inventory A/P Accrual, Invoice Price Variance, Expense, Sales and Cost of Goods Sold accounts are required. The other accounts are used as defaults or are not required.

Leave a Reply

Want to join the discussion?Feel free to contribute!